The Company recognize the importance of strengthening corporate governance in order to ensure the sustainable growth of our group and maximize corporate value for all stakeholders, and the Company will strive to achieve this goal based on the following basic policies.

1. Ensure transparency and soundness by strengthening management oversight functions

2. Establish a prompt decision-making and efficient execution system

3. Clarification of accountability

4. Disclosure of information with emphasis on timeliness, continuity, and fairness

The Company has established the "Meiko Network Japan Group Corporate Governance Guidelines" to clarify the status of its efforts and policies with respect to each principle of the Corporate Governance Code, and to fulfill its fiduciary and explanatory responsibilities.

(Board of Directors)

The Board of Directors serves as the highest decision-making body in management. The Board of Directors makes important decisions on matters stipulated in laws, regulations, and the Articles of Incorporation, as well as management policies, strategies, and management plans, and supervises business execution based on those decisions. The Board of Directors is composed of four directors (excluding directors serving on the Audit and Supervisory Committee) and four Audit and Supervisory Committee members (including four outside directors). In principle, the Board of Directors meets once a month, and extraordinary meetings are held flexibly as necessary.

(The Audit and Supervisory Committee.)

The Company has established the Audit and Supervisory Committee, which is composed of four members of the Audit and Supervisory Committee (one full-time member and three outside directors). The Audit and Supervisory Committee audits the execution of duties by directors from an independent perspective. In principle, the Audit and Supervisory Committee meets once a month, and extraordinary committees are held as necessary. In accordance with the policy established by the Audit and Supervisory Committee, the Audit and Supervisory Committee Members of the Board of Directors shall request reports and investigations required of Directors, etc. who are not Audit and Supervisory Committee Members, and conduct audits and supervision of management in cooperation with the Internal Audit Office, Accounting Auditors, etc.

(Internal Audit Office)

The Company has established the Internal Audit Office, which is independent from business divisions, and the chief of the internal audit one and the two members of the Internal Audit Office conduct business audits based on the Internal Audit Regulations to cover the entire Group. We report the results of audits to the representative directors and the Audit and Supervisory Committee on whether operations are conducted in compliance with laws and regulations and internal regulations and whether operations are conducted in a rational manner. The Representative Director directs the divisions to be audited to take necessary measures, measures, etc. based on the report of the audit results, and reports the results to maintain and improve internal controls. In addition, the Internal Audit Office, the Audit and Supervisory Committee, and the accounting auditor regularly exchange information to conduct audits effectively and efficiently.

(Nomination and Compensation Committee)

In Nov. 2022, companies established the Nomination and Compensation Committee, chaired by the Audit and Supervisory Committee, as an advisory body to the Board of Directors. The Board of Directors consists of six committees: Chairperson and Representative Director, the President and Representative Director, and four members of the Audit and Supervisory Committee. The Board of Directors is composed of a majority of outside directors. The Board of Directors makes recommendations on the appointment and dismissal of directors and executive officers, the determination of compensation, the development of directors and executive officers, and the succession plan after prior deliberation by the Committee. The Board of Directors ensures independence and objectivity and the transparency of the decision-making process.

(Sustainability Committee)

In Nov. 2022, companies established the Sustainability Committee to recognize issues related to sustainability that need to be resolved through our business activities as new revenue opportunities and to accelerate our efforts to realize a sustainable society. This committee, chaired by the president and CEO, is made up of senior management, including outside directors. It determines important issues for realizing sustainability management, including not only contributing to a decarbonised society, but also providing high-quality education, respecting human rights and further penetrating diversity. Based on the Basic Policy on Sustainability, the committee strives to realize both corporate value and improvement in environmental and social value. In addition, we endorse the recommendations of TCFD* (Climate-related Financial Disclosure Task Force) and promote voluntary and proactive information disclosure based on the recommendations in order to examine long-term strategies using scenarios that are consistent with our own business with regard to climate change-related risks and opportunities.

(Risk Management Committee)

The Company has established the Risk Management Committee, which is composed of directors, executive officers, and division heads, in order to properly implement risk management. The committee meets regularly to formulate policies, measures, and annual plans related to risk management, to ascertain the status of risk management, to provide guidance on risk avoidance measures to the divisions in charge of individual risk management, and to provide guidance on business continuity related to the company's main and important businesses and other important operations.

(Compliance Committee)

We have established the Compliance Committee, which is composed of directors, executive officers, and division heads, to strengthen and enhance our compliance system. The committee meets regularly in cooperation with counsel and is responsible for fostering an in-house culture to ensure thorough compliance and promote initiatives, formulating compliance education policies, and discussing measures to be taken in the event of doubts regarding compliance in the execution of business.

The Company conducts audits by outside corporate auditors as stipulated in Article 2, Item 15 of the Companies Act.

Currently, all four corporate auditors are outside corporate auditors, and they play the role of monitoring management from their objective and professional perspectives. Four of them have been appointed as independent directors.

We believe that our outside directors and outside corporate auditors fulfill the important function and role of management oversight by providing objective and neutral auditing and supervision based on their high degree of independence and expertise, thereby contributing to the strengthening of our corporate governance system.

[Outside directors who are members of the audit committee]

Mr. Hiroshi JINZA Ms. Nanako AONO, Ms. Hitoko KUMAO, and Ms. Kanako IWASE were elected as outside directors who are members of the Audit Committee at the Ordinary General Meeting of Shareholders held on November 15, 2024.

Mr. Hiroshi JINZA has extensive experience and knowledge of finance, finance and corporate management at financial institutions and other organizations over many years, as well as extensive experience as an outside director at other companies.

In addition, based on his experience working overseas, he has provided effective advice as a full-time Audit and Supervisory Board Member on important management matters of the Company from a global perspective. We have elected him because we believe that he will continue to monitor the overall management of the Company and enhance the effectiveness of our audits.

Ms. Nanako AONO has extensive financial and accounting knowledge as a certified public accountant, as well as a wealth of experience and broad knowledge of corporate management and experience as an outside director at other companies. By doing so, she provides us with advice that will help ensure the transparency of our management and further strengthen our corporate governance. We have elected her as we believe that she will continue to advise us on the overall management of the Company and enhance the effectiveness of our audits.

Ms. Saiko KUMAO has expertise in corporate law and experience as a director and audit and supervisory committee member. At a time when ESG-based management and strengthening corporate governance are becoming increasingly important in corporate management, she has provided us with advice that helps ensure the transparency of our management and further strengthens corporate governance. We have selected her as a person who can be expected to continue to contribute to the management of the Board of Directors with her expertise as a lawyer and a wide range of perspectives.

Ms. Kanako IWASE aims to solve social issues through management, and has provided employment opportunities to support the independence of refugees living in Japan and work experience opportunities for children in child welfare institutions. She has an understanding of human rights, sustainability, and SDGs, and has extensive experience as a manager. She has also provided advice from her unique perspective on our company's sustainability management. We has selected her as a person who can be expected to continue to contribute to the management of the Board of Directors with her expertise as a manager and a wide range of perspectives.

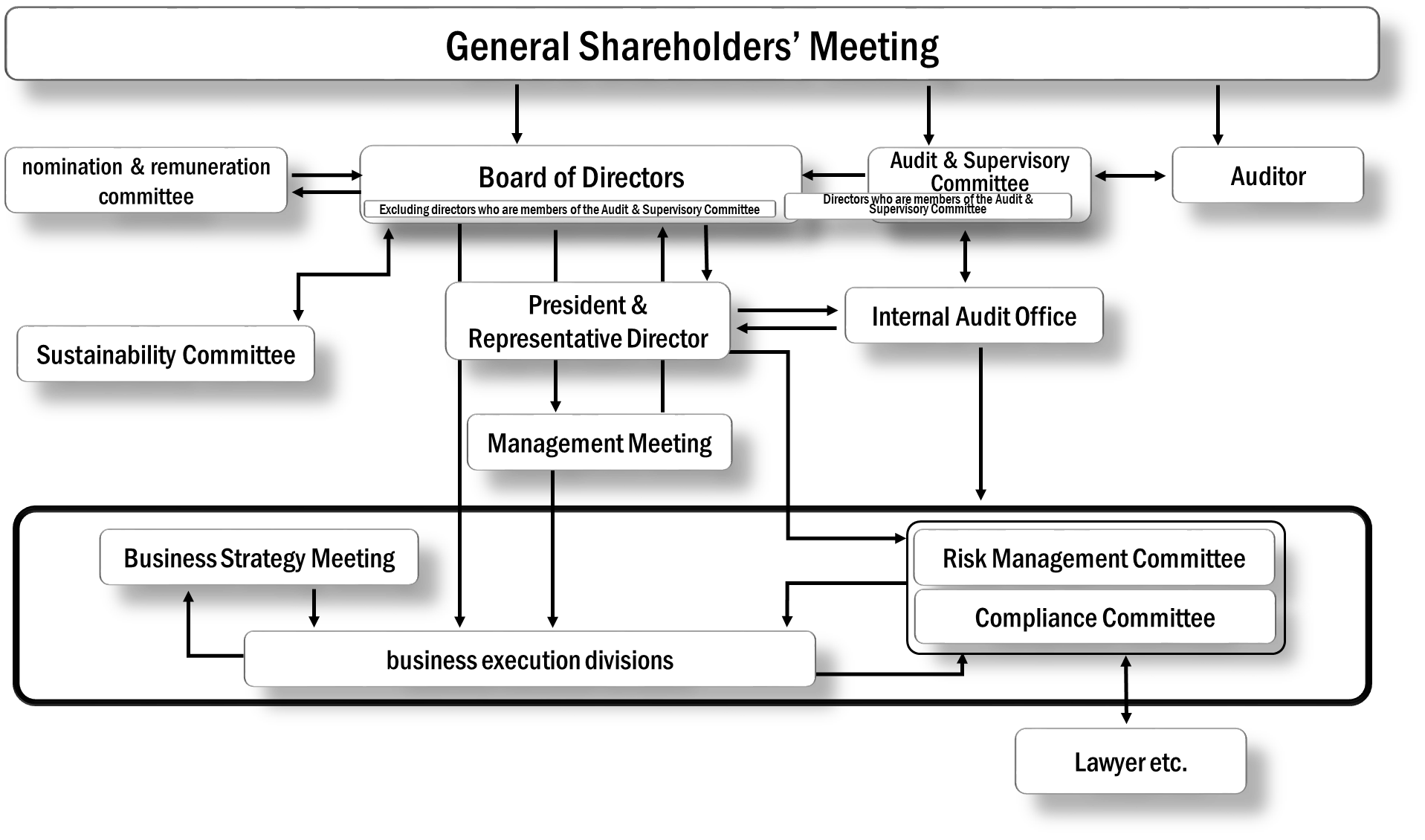

The diagram below shows an overview of our business execution system and management oversight.

1. Method of Determination of Policy on Determination of Remuneration for Individual Directors

Our basic policy is to ensure that the remuneration of our directors' functions sufficiently as an incentive for the sustained improvement of corporate value. When determining the remuneration of individual directors, it is determined by a process that is transparent and objective, and that the remuneration of each director is at an appropriate level based on his or her respective responsibilities.

Remuneration for executive directors consists of base remuneration as fixed remuneration (monthly remuneration) and non-monetary remuneration (stock remuneration). The policy for determining such remuneration is resolved at the Board of Directors meeting held on Oct. 23, 2024. Regarding remuneration, etc. for individual outside directors, non-monetary remuneration (stock remuneration) is not introduced because the remuneration is independent from business execution, and only base remuneration is paid as monthly remuneration.

2. Summary of Details of Decision-Making Policies

(a)Basic Compensation Policy

The total annual remuneration of directors is resolved at the Ordinary General Meeting of Shareholders. Compensation for each director is determined by the Board of Directors after the President and Representative Director prepares a draft and consults with the Nomination and Compensation Committee based on the details of each director's duties and our circumstances.

(b) Policy on Non-Monetary Compensation (Stock Compensation)

Directors (excluding Outside Directors) The non-monetary compensation for Directors (excluding Outside Directors) consists of a restricted stock compensation plan as performance-linked compensation (hereinafter referred to as the “RS Plan”). The RS Plan consists of a restricted stock compensation plan (hereinafter referred to as the “RS Plan”) as performance-linked compensation.

The RS Plan is a system under which the Company and Directors enter into a restricted stock allotment agreement and shares with restrictions on transfer are allotted in accordance with the agreement, with the aim of providing Directors with further incentives to continuously improve the Company's corporate value by holding shares during the restricted period, as well as to promote further value sharing with shareholders. The purpose of this system is to promote the sharing of value with shareholders. The allotment of restricted stock and the number of shares to be allotted are drafted by the President and Representative Director at a certain time, based on the position, Business performance, their contribution, the Company's situation, and several evaluation items including ESG, and are decided by the Board of Directors after consultation with the Nomination and Compensation Committee.

(c) Policy on determining the amount of basic remuneration or the amount of non-monetary remuneration, etc. as a percentage of the amount of remuneration, etc. for each individual director

The percentage of remuneration for each type of director will be determined by the Board of Directors after consulting with the Nomination and Compensation Committee, based on the duty scale of each director and the level of remuneration of companies belonging to industries and types of business that are similar to ours, such as the content of the duties of each director and our situation.

(d)Reasons for the Board of Directors' judgment that the contents of remuneration, etc. for each individual director conform to the said policy.

In determining the details of base remuneration for each individual director, the President and Representative Director prepares a draft based on the duties of each director and the state of the Company in accordance with the policy for determining base remuneration determined by the Board of Directors, and after consulting with the Nomination and Compensation Committee, the Board of Directors makes a decision, which we believe is in line with the determination policy. The Company believes that this is in line with the decision-making policy. In addition, with regard to individual non-monetary compensation (stock compensation) for directors (excluding outside directors), the Company has confirmed that the method of determining the details of compensation, etc. and the details of the determined compensation, etc. are consistent with such determination policy and that the report from the Nomination and Compensation Committee is respected, and the Company believes that this is in line with the determination policy.

3. Matters concerning resolutions at general meetings of shareholders with regard to remuneration, etc. for directors and auditors

The 38th annual meeting of shareholders held on November 18, 2022 resolved that the maximum amount of remuneration for Directors (excluding Directors who are members of the Audit Committee) shall be 300 million yen per year (including bonuses for Directors and excluding salaries for employees) (the number of Directors at the conclusion of the said meeting was five).

In addition to this, the Company introduced a stock compensation plan for directors (excluding directors who are members of the Audit Committee and outside directors) at the 39th annual meeting of shareholders held on November 17, 2023. The maximum amount of the RS plan was resolved at the 40th annual meeting of shareholders held on November 15, 2024 to be an annual amount not exceeding 100 million yen and a total number not exceeding 100,000 shares, in addition to the monetary compensation limit (the number of directors (excluding directors who are members of the Audit Committee and outside directors) at the end of the same annual meeting of shareholders is four).

The maximum amount of remuneration for directors who are Audit and Supervisory Committee members is as follows.

The maximum amount of remuneration for Directors who are Audit Committee members was resolved at the 38th Annual Meeting of Shareholders held on November 18, 2022 to be 50 million yen per year (the number of Directors who are Audit Committee members at the conclusion of the said Annual Meeting of Shareholders is four).